The National Programme on High Efficiency Solar PV (Photo Voltaic) Modules aims to build an ecosystem for manufacturing of high efficiency solar PV modules in India, and thus reduce import dependence in the area of Renewable Energy. During the Budget 2022 Speech, the Honorable Finance Minister of India mentioned that “To facilitate domestic manufacturing for the ambitious goal of 280 GW of installed solar capacity by 2030, an additional allocation of INR 19,500 crore for Production Linked Incentive (PLI) for manufacture of high efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules, will be made.”

The Government of India (“GoI”) through Ministry of New and Renewable Energy (MNRE) has approved USD 2.61 billion (INR 195 billion) to achieve gigawatt scale manufacturing of high efficiency solar PV modules under the second phase (Tranche II) of PLI Scheme which was approved by the cabinet on 21 September 2022 and guidelines issued on 30 September 2022. The PMA (Project Management Authority) for the Solar PLI (Tranche II) is SECI (Solar Energy Corporation of India Limited) which will issue bidding document for selection of applicants.

The manufacturing units sanctioned under the programme would be eligible for getting PLI on annual basis on sales of high efficiency solar PV modules for 5 years from commissioning or 5 years from scheduled commissioning date, whichever is earlier.

The various aspects of Solar PLI (Tranche II) has been further decoded as mentioned below:

- Eligible product and categories

- Eligible Bidders and Criteria of Selection of bidder

- Trajectories of Module Performance and Local Value Addition (LVA)

- Calculation of PLI Incentives and capacity allocation

- Penalty for non-compliance by successful bidder

1. Eligible product and categories

Based upon the extent of integration proposed, the bidder can opt for bidding for any of the following three baskets:

| Basket No. | Code | Description |

| 1. | P+W+C+M | Stage-1: Manufacturing of Polysilicon (P) from outsourced (imported/domestic) M.G. Silica + Stage-2: Manufacturing of Ingots-Wafers (W) from Stage-1 Polysilicon + Stage-3: Manufacturing of solar cells(C)from Stage-2 Wafers + Stage-4: Manufacturing of Modules (M) from Stage- 3 Solar Cells or fully integrated manufacturing of Thin Film plant or fully integrated plant of any other technology |

| 2. | W+C+M | Stage-2: Manufacturing of Ingots-Wafers from outsourced Polysilicon + Stage-3: Manufacturing of solar cells from Stage-2 Wafers + Stage-4: Manufacturing of Modules from Stage- 3 Solar Cells or similar level of integration of any other technology |

| 3. | C+M | Stage-3: Manufacturing of solar cells from outsourced Wafers + Stage-4: Manufacturing of Modules from Stage- 3 Solar Cells or similar level of integration of any other technology |

The capacities will be allocated in separate categories based on the maximum fund allocation made for each category. This will enable competition among bidders across different levels of integration while promoting a diversified supply chain in the domestic manufacturing market:

| Basket No. | Code | Fund Allocation (crore Rs.) |

| 1 | P+W+C+M | 12,000 |

| 2 | W+C+M | 4,500 |

| 3 | C+M | 3,000 |

In case a particular category is undersubscribed, i.e. funds are left over even after all bid capacity has been awarded in the category, there will be inter-category fungibility of funds. To illustrate, if capacity equivalent to only Rs. 2500 crore of W+C+M have been awarded among all bidders, the remaining Rs. 2000 crore would be allocated for any unmet bid capacity in P+W+C+M category first and then in C+M category.

There would be further category for greenfield and brownfield projects. Greenfield new solar PV module manufacturing units will be eligible for PLI. Brownfield projects will also be allowed to participate subject to the fulfilment of prescribed eligibility criteria for Greenfield projects as stipulated in the guidelines. PLI receivable for such Brownfield projects will be 50% of the PLI receivable for Greenfield projects. Brownfield projects means all such new solar PV manufacturing capacities set up by the existing solar PV manufacturers which share some common infrastructure facilities with the pre-existing solar PV manufacturing capacities or addition of new manufacturing lines in the existing solar PV manufacturing facilities. Infrastructure being set up under LoAs issued by IREDA under previous tranche of PLI Scheme shall be considered as part of Greenfield Projects under these guidelines.

2. Eligible Bidders and Criteria of Selection of bidder

The beneficiaries of the PLI scheme will be selected through a transparent selection process. The applications will be shortlisted after consideration of the various parameters as enumerated below. It is proposed to call bids for the award of manufacturing capacities towards additional fund allocation.

In order to qualify for the bid, the applicant manufacturer will have to promise minimum integration across solar cells and modules. Further, the applicant manufacturer will have to undertake to set up a manufacturing plant of minimum 1,000 MW capacity (1,000 MW each for all individual stages included in the manufacturer’s proposal). The maximum capacity that can be bid for, i.e. the manufacturing capacity that a bidder would have to commit to set up is:

- 10 GW for P+W+C+M;

- 6 GW for W+C+M and

- 6 GW for C+M categories.

However, the maximum capacity that will be awarded to one bidder under the PLI scheme would be 50% of the bid capacity. The maximum bid capacity includes any capacity bid for in the earlier bid, against which PLI has been awarded as per LoA issued by IREDA. The bidder manufacturer can be a:

- Single company or a

- Joint Venture/ Consortium of more than one company. However, in case of Joint Venture/Consortium, a partner/company will be allowed to tie up their manufacturing capacity (of any stage) with another partner/company for one bid only.

The manufacturing units which have availed any benefit under the:

- MNRE’s tender(s) for solar Power Purchase Agreements linked to PV manufacturing or

- SIPS/ M-SIPS / SPECS schemes of Ministry of Electronics & Information Technology (MEITY),

will not be eligible for benefits under this programme.

However, any benefit under SIPS/ M- SIPS/ SPECS/ Manufacturing Linked Tender can be availed by manufacturers for the difference of offered bid capacity and double the PLI awarded capacity. For example, for a bid capacity of Y, if a manufacturer has been awarded PLI capacity of X, then it may avail any benefit under SIPS/ M-SIPS/ SPECS /Manufacturing Linked Tender, for capacity in excess of double the PLI awarded capacity i.e., Y-2X. SECI shall obtain an undertaking from bidders in this regard.

The bidders will submit the following details:

| Sl. No. | Parameter |

| a | Extent of Integration |

| b | Manufacturing Capacity proposed to be set up (in GW) |

| c | Year-wise percentage of Local Value Addition (LVA) (expressed as fraction of 1) |

| d | Year-wise performance parameters of manufactured modules (module efficiency and module’s temperature co-efficient of Pmax) |

The applicant shall, in its application, also declare the type of technology proposed to be set up, plan for local value addition, and the estimate employment generation and exports during the tenure of the scheme.

The time period allowed for commissioning of Solar PV manufacturing units under the scheme is as follows:

| Level of integration | Time allowed for commissioning |

| P+W+C+M | Within 3 years from the date of letter of award |

| W+C+M | Within 2 years from the date of letter of award |

| C+M | Within 1.5 years from the date of letter of award |

Further, the manufacturers will be required to set up facilities for recovery and recycling of solar waste. The manufacturers will be encouraged to adopt circular economy principles in their manufacturing and supply chains. Also, the successful bidders will ensure that at least 20% of the electricity consumption for the solar PV manufacturing plant will be sourced from renewable energy sources. Different modalities for compliance of this requirement will be permitted. Detailed provision in this regard will be specified in tender documents.

Further, manufacturing units which have imported capital goods for setting up the module manufacturing facility before the last date of bid submission will not be eligible for participation under the PLI scheme. However, goods, equipment and services for which contracts have been concluded after 11 November 2021 in anticipation of PLI, will be eligible for counting towards calculating benefits under the PLI Scheme Tranche-II.

The bid with the highest efficiency in the first year of production shall be allocated the bid capacity. In case of a tie, for all tied bids, the bid with the highest efficiency in the second year of production shall be allocated bid capacity and so on. In case two bids have the exact same efficiency trajectory over all five years, LVA trajectory shall similarly be compared year wise. In case, both efficiency and LVA trajectory over all 5 years is the same, the bids will be prioritized on the basis of bid capacity and if bid capacities are also the same, then either the tie-breaker would be decided by draw of lots or both the bidders will be given the same ranking and allotted manufacturing capacity accordingly. However, in case of insufficient funds, the remaining possible allocation shall be divided equally between the two tied bidders.

In case the funds available at any point is sufficient to allocate only a part capacity of a bid that is next in priority, such a bidder would be free to exercise refusal on accounts of economies of scale and this allocation shall be offered to the next bidder in sequence.

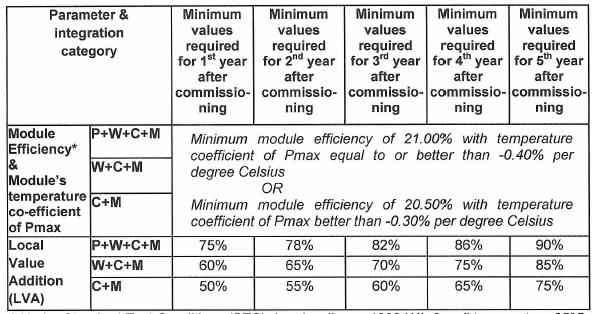

3. Trajectories of Module Performance and Local Value Addition (LVA)

* Under Standard Test Conditions (STC), i.e., Irradiance 1000 W/m², cell temperature 25°C, air mass (AM)= 1.5;

4. Calculation of PLI Incentives and capacity allocation

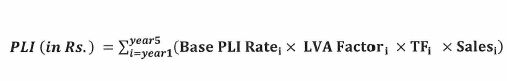

The formula for calculation of PLI amount shall be as follows:

where,

a) i: is the year counted from date of scheduled or actual commissioning (whichever is earlier) ranging from 1 to 5

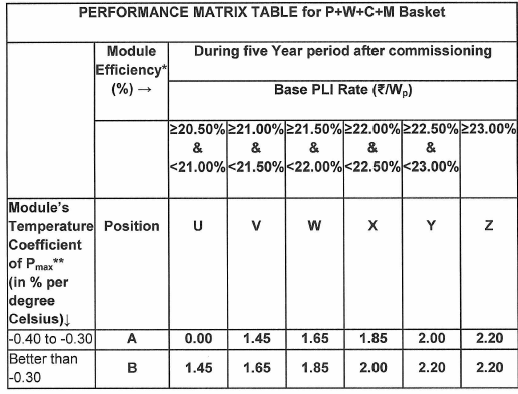

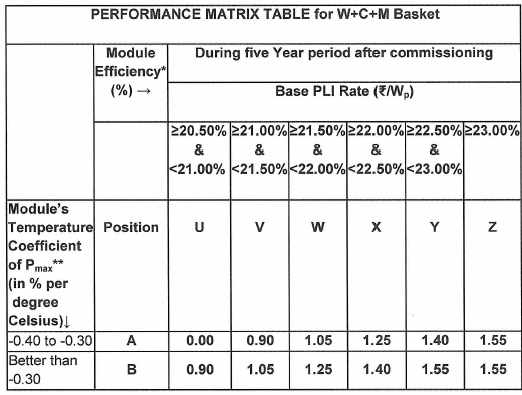

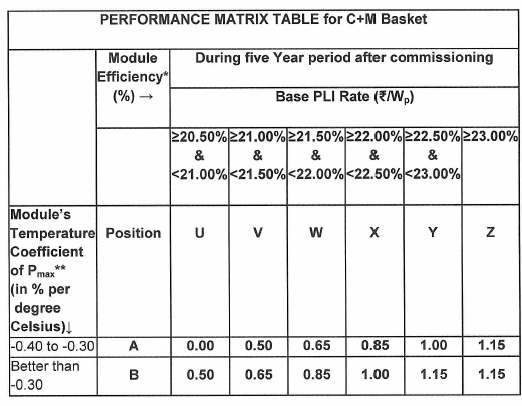

b) Base PLI Rate: On the basis of module efficiency and module’s temperature co-efficient of Pmax (herein after also referred as module’s temperature co-efficient). Base PLI rate will be determined in Rs./Watt peak (Rs/Wp) as per the performance matrix tables given below. The Base PLI rate increases with module efficiency to motivate and incentivise manufacturers for producing higher efficiency modules which also require higher investment in R&D.

c) LVA factor: LVA is a function of the percentage of LVA submitted for the ith year. expressed as a fraction of 1 in bid submitted for the ith year. LVA factor is derived as per the following table:

| LVA% | LVA% less than 50% | LVA% >=50% but less than 60% | LVA% >=60% but less than 70% | LVA% >=70% but less than 80% | LVA% >=80% but less than 90% | LVA% >=90% |

| LVA Factor | 0 | 0.73 | 0.79 | 0.85 | 0.92 | 1 |

Manufacturers are encouraged to source their material from domestic market. The PLI amount will increase with the increased local value addition. The percentage of Local Value Addition will be calculated as follows: [(Sale value of Module as per GST invoice excluding net domestic indirect taxes) – (Value of direct and indirect imported materials and services (including all customs duty) as per Bill of Entry filed in Customs, used in manufacture of module)] / [(Sale value of Module as per GST invoice excluding net domestic indirect taxes] x 100%.

d) TF or Tapering Factor: In order to give a signal to solar PV manufacturing industry that they will need to be competitive after five years, the PLI rate (₹/Wp) will be higher in the beginning and lower towards the end of five-year period. To achieve the objective of tapering down the PLI rate (in ₹/Wp), the PLI rate (₹/Wp) will be multiplied by a tapering factor of 1.4 for the 1st year of the five-year PLI disbursement period followed by a tapering factor of 1.2, 1.0, 0.8 and 0.6 for the 2nd, 3rd, 4th and 5th year of the PLI disbursement period respectively.

| Year | 1 | 2 | 3 | 4 | 5 |

| Tapering Factor | 1.4 | 1.2 | 1 | 0.8 | 0.6 |

e) Sales (in Wp) is the net sales of solar PV modules of performance parameters (efficiency and temperature coefficient) and LVA equal to or better than those given, as per para 3.2(vi). The PLI disbursed to a manufacturer will be calculated as per formula at para 5.2 and will depend on sales or the maximum eligible capacity awarded under the PLI scheme, whichever is less, actual performance and actual local value addition achieved, provided that only those module will be counted in sales whose performance and LVA satisfy the levels given as para 3.2 (vi).

Consequently, in case of delayed commissioning, the PLI period will reduce from 5 years by the quantum of such delay in commissioning. A team constituted by MNRE or SECI will visit the manufacturing unit immediately after its commissioning to verify promised extent of integration, manufacturing capacity, efficiency and temperature coefficient of modules. The manufacturers will be asked to give a self-declaration and a Statutory Auditor’s or Chartered or Cost Accountant’s certificate in support of claims of PLI.

The manufacturers will be required to provide documents in support of the PLI claimed for a particular year based on (i) sales (watt) of modules, (ii) percentage of local value addition and (iii) PLI rate (as per the position in Performance Matrix).

5. Penalty for non-compliance by successful bidder

In case a selected manufacturer fails to meet the extent of integration or manufacturing capacity promised at the time of selection, it will not get any PLI till it overcomes these deficiencies. If the manufacturer achieves the promised levels subsequently, it will be eligible for PLI from the next month following the month in which it achieved the promised levels of integration and capacity. However, in such cases, the manufacturer will not be able to get PLI for full 5 years since 5 years PLI is counted from the scheduled date of commissioning of the plant or the actual date of commissioning, whichever is earlier. In case, the modules manufactured by a selected manufacturer do not meet the minimum parameters as per the table for trajectories of minimum module performance and minimum LVA at para 3.2 (vi), then it will not get any PLI in respect of such modules.

Bidders will have to submit, at the time of bid submission, Earnest Money Deposit (EMD) as prescribed in the tender document. The tender document will inter-alia, contain provisions regarding forfeiture of EMD in case of selected bidder refusing to submit the requisite documents/ Performance Bank Guarantees (PBG) as per tender document / extant guidelines or the selected bidder not meeting eligibility criteria upon submission of documents.

Bidders who have been awarded capacities will have to submit Performance Bank Guarantees (PBG), at the time of accepting the award as per extant Ministry of Finance guidelines. In case they fail to implement the promised ‘Extent of integration’ or the ‘Manufacturing capacity’ submitted by them in their bids, within the scheduled commissioning date, Bank Guarantees commensurate to the manufacturing commitments not fulfilled by the bidder will be forfeited by SECI and balance Bank Guarantees will be released by them. Detailed modalities in this regard will be given in tender documents. Encashment of bank guarantees, accrued interest or other charges collected by SECI will be remitted to the Consolidated Fund of India by SECI as per rule-230(8) of GFRs 2017.

To ensure that the bidder-manufacturers quote realistic levels of year-wise module performance and LVA, in case, for any given year, the bidder-manufacturer falls short on quoted level of module efficiency/ quoted level of temperature co-efficient

of max quoted level of LVA, but meets the minimum requirements as prescribed in the trajectories of module performance and LVA at para 3.2(vi), the amount of PLI to be disbursed to it for that given year, will be limited to 75% of the PLI amount as per the actual achieved levels of module efficiency, temperature co-efficient of Pmax and LVA.

The Solar PLI scheme (Tranche II) would help in building a huge domestic manufacturing base. This would be not only for cells and modules, but also polysilicon and wafers which was missing in the Indian market. The focus on efficiency and local value addition in tranche II of the scheme is an indicator that government’s goal is not restricted to merely promoting manufacturing in India but has been enhanced to providing high-efficiency solar PV modules and ensuring development of overall supply chain for manufacturing in India.

Also, it will protect the country from any supply side disruption which was witnessed during the onset of Covid-19 and then the Russian invasion of Ukraine. It will help India become more self-reliant and protect itself from the vagaries of price volatility of imported modules and cells

However, the incentive amount has been substantially reduced compared to the previous scheme. Accordingly, the bidders need to also consider on incentives under the State Industrial Policy, customs schemes, etc, while analysing feasibility for manufacturing solar PV modules in India.

Being the scheme is limited in terms of number of application involving bidding process, involvement of State Government for infrastructure and additional incentives, time line and eligibility conditions, it is utmost important to have adequate project management and support to deliberate and accordingly prepare the application and apply to obtain the approval.

About the Author:

Vineet has over 17+ years of consulting experience in leadership role in Tax and Regulatory Stream [Indirect tax including GST (around 13 years in Big 4)] and working with leading players in diverse industry sectors including renewable sector. He has delivered successfully as part of Darda Advisors LLP on various approvals and disbursements under Central and State Policies including ongoing MEITY and other Ministries’ PLI Schemes. Vineet has conducted various sessions (Seminars and webinars) on various tax and regulatory topics (including GST), Central and State schemes at Client’s place, Business Parks, and other forums (ASCI, FTCCI, JICA, KOTRA, EPC, ICAI, ICFAI, JITO, RGA and others).

https://www.linkedin.com/in/d-vineet-suman-a5a28729

You can reach out on 91-99529 26239 or email [email protected].

Follow Darda Advisors LLP: https://www.linkedin.com/company/darda-advisors-llp