Note: This article is published in FTCCI Review magazine dated 21 December 2022 which can be read at the below link (Refer pg.no. 36 to 38) :

https://www.ftcci.in/source/ftapcci/FR%202022/FR%202022%2012%2021.pdf

To further improve on Ease of Doing Business (EoDB), the Ministry of Finance issued new IGRCS, 2022 which will further facilitate international trade growth and expand the current regulatory scope. For the first time, IGCRS,2022 will specifically also apply to importers of gold under the India-UAE CEPA. The new IGCRS, 2022 includes many new provisions and clarifications, including the time period for utilization of goods, immediate re-credit of bonds irrespective of monthly returns filing, and widened procedure to include cases where the imported goods have a specified end use. Accordingly, the importers need to ensure that adequate maintenance of returns and records and compliance is taken care of.

The Ministry of Finance through Department of Revenue has notified the revamped Customs (Import of Goods at Concessional Rate of Duty or for Specified End Use) Rules, 2022, (IGCRS, 2022) which supersedes the existing IGCR 2017 [Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017] with effect from 10 September 2022. Upon consideration of various suggestions to further facilitate the trade and to expand the scope of application, the IGCRS, 2022 have been notified, while retaining the basic contours of IGCR, 2017. It is pertinent to note that these changes are of the nature that broaden the scope of coverage of IGCR and ensure that useful additional data fields are effectively captured.

Following are key aspects of relevant notifications and circulars issued related to IGRCS, 2022:

Widened scope of IGRCS, 2022 by including ‘Specified end use’:

The IGCRS, 2022 is now applicable not only to those Customs notification which mandated its compliance, but also covers, any Notification issued under Section 11 or Section 25(1) of the Customs Act, 1962, wherein the duty benefit is dependent upon:

- The use of the goods imported for the manufacture of any commodity or

- Provision of output service or

- Being put to a specified end use.

Rule 3(m) of IGCRS, 2022 defines “specified end use” as dealing with the goods imported in a manner specified in the notification and includes supply to the intended person and the term “end use recipient” shall be construed accordingly. Thus, any Notification issued under either Section 11 or Section 25(1) of the Customs Act, 1962, which prescribes a specific end use or a manner in which such goods are to be dealt with, appear to be falling under the ambit of IGCRS, 2022. The recent circular also clarified that ‘End use’ may be specified by a notification under sub-section (1) of section 25 or under section 11 of the Customs Act,1962.

This provision has been introduced to enable the tracking of these goods by the Customs authorities to ensure that the goods are used in specified manufacturing and not in the replacement market.

Such widened coverage of IGCRS, 2022 may result in unintended implications for the importer which may include rejection of exemption at the import stage itself or post-import recovery of differential duty along with penal consequences. Even if complied with IGCRS, 2022; certain imports by nature would not be able to be used within prescribes timelines of Rule 10 of IGCRS,2022 which would again entail actions under IGCRS, 2022 and the Customs Act, 1962.

IGCRS, 2022 vis-a vis India-UAE CEPA:

The import of gold under the India-UAE CEPA prescribes tariff rate quotas (TRQ). In this context:

- The Importer shall follow IGCRS, 2022

- The importer, having provided a one-time intimation in Form IGCR-1 at the common portal, can generate an IIN number and undertake multiple imports against the same.

- Imports pertaining to multiple TRQ holders can be clubbed together and imported in a single lot. However, it is to be ensured that when filing the bill of entry, the quantities against each TRQ holder need to be mentioned as a separate line item.

- The importer shall maintain records of the supply made to each end use recipient and shall mention the same in the monthly statement under form IGCR-3.

- Importer shall follow the IGCRS,2022 procedure till its supply to end-use recipient and filing of monthly statement.

Bond & Bank Guarantee:

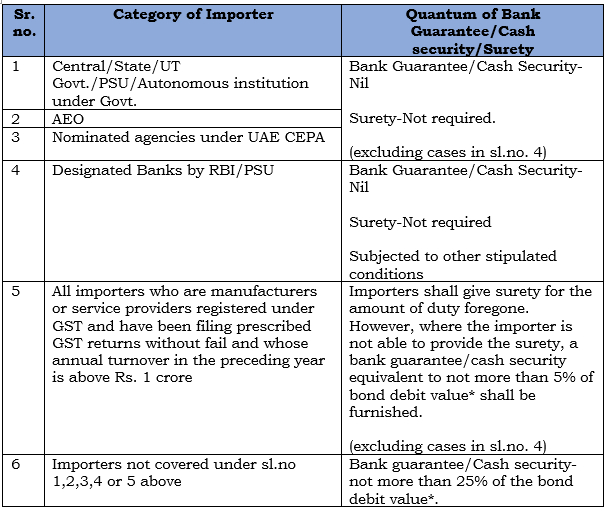

In view of the changes introduced to the IGCRS, 2022, the Bank guarantee/cash security/surety shall be taken as per the following norms for the purpose of extending the benefit:

The IGCRS has also given enough indication that legible importers should take AEO (Authorized Economic Operator) Status to have Nil amount of BG/CS or any Surety. FTCCI have deliberated on AEO in its FTCCI Review edition of November 2021 as ‘Authorised Economic Operator – Avail ‘Clear First-Pay Later’ and other Supply Chain benefits’.

Time period for utilization of goods:

The IGCRS, 2022 clarify that the time period of utilization is the same as the time period for compliance. When the time period for utilization is specified in the notifications, the said time period will apply. If not specified, the time period of six months will apply.

Further, IGCRS, 2022 introduced a provision wherein the jurisdictional commissioner can further extend such period of six months by another three months in case the importer is unable to utilize goods imported for intended purpose under IGCR, 2017 within the prescribed time period of six months. Such extension will only be granted once the importer furnishes sufficient reasons for not conforming to the time period so prescribed, which were beyond the importer’s control.

Other changes:

As a trade facilitation measure, a new Form IGCR-3A has been notified for confirmation of consumption for intended purpose at the common portal at any point in time for immediate re-credit of the bond by the jurisdictional AC/DC, without waiting for the filing of monthly statement on the 10th of every month. The details filed in form IGCR-3A shall get auto populated in the monthly statement of the subsequent month, which has to be only confirmed by the importer.

IGCRS, 2022 is prescribing a series of compliance requirements at different levels when compared with erstwhile Rules. These changes are including but not restricted to one-time prior intimation, furnishing of surety/security/ undertaking, maintenance of record and Form IGCR-3, Job work & Unit Transfer, time limit for utilization, re-export or domestic clearance etc.

Therefore, to avoid disputes, it is imperative that the industries should re-visit and review the exemption notifications and related end use mentioned in the fine print vis-à-vis compliance under IGCRS, 2022.

About the Author – VINEET SUMAN DARDA

Vineet Suman Darda is an experienced professional with qualifications of FCA, ACS, CMA (I) and have experiences of 17+ years working in Big 4s (EY, Deloitte, KPMG) and own consulting firm on various tax and regulatory matters in leadership role. He has conducted sessions on various tax and regulatory topics at Business Parks, Business Associations and other forums (ASCI, FTCCI, JICA, KOTRA, EPC, ICAI, ICFAI, JITO, RGA and others)