Integrated battery value can be broadly divided (at the sales end) into the battery pack and the ACCs (Advance Chemistry Cell). ACCs are the new generation advance energy storage technologies that can store electric energy either as electrochemical or as chemical energy and convert it back to electric energy as and when required. The consumer electronics, electric vehicles, advanced electricity grids, solar rooftop etc. are major battery consuming sectors and it is expected that the dominant battery technologies will control some of the world’s largest growth sectors.

The Government of India (“GoI”) in March 2019, launched the National Mission on Transformative Mobility & Battery Storage (the “Mission”). The Mission, apart from notifying various policy interventions to promote electric vehicle penetration in India, has proposed the National Programme on Advance Chemistry Cell Battery Storage (the “Programme”).

On 12 May 2021, India’s Union cabinet approved for the implementation of Production Linked Incentive Scheme for the programme (‘PLI Scheme’) which is further notified on 9 June 2021 vide notification no. S.O. 2208(E) with an outlay of INR 18,100 crore (USD 2.49 billion) and RFP (Request for Proposal) document is issued on 22 October 2021 and the last date to submit the technical cum financial bid is 31 December 2021.

By the introduction of the PLI scheme, it will further facilitate demand for EVs, which are proven to be significantly less polluting and have already given various incentives such as recent increase in FAME II (Faster Adoption and Manufacturing of Electric Vehicles in India Phase II) subsidies for electric two wheelers by 50%, with an cap of 40 per cent of the cost of vehicles, expected to extend FAME II scheme by two years till 2024, lithium battery manufacturers eligible for investment-linked income tax exemptions and other indirect tax benefits etc. The main implementing agencies for the scheme are the Department of Heavy Industries (DHI) and NITI Aayog. The DHI issued RFP (Request for Proposal) vide No: 01(05)/2019-AEI (19587) dated 22 October 2021 for inviting bidders under PLI scheme. We have covered following relevant aspects of PLI Scheme in this article

- Eligible Product and Technology parameter

- Eligibility Criteria

- Incentive rate and computation

- Timeline

- RFP related key aspects

- Other aspects

- Eligible Product and Technology Parameter

The PLI Scheme is intended to establish local cumulative manufacturing capacity by individuals, LLPs, funds, private entities, public entities or other international entities of:

- 50 Giga Watt Hour (GWh) of ACC [Each beneficiary firm will have to commit to set up minimum of five (5) GWh of ACCs manufacturing facility] and

- 5 GWh of Niche ACC technologies [minimum threshold capacity of 500 MWh per beneficiary firm].

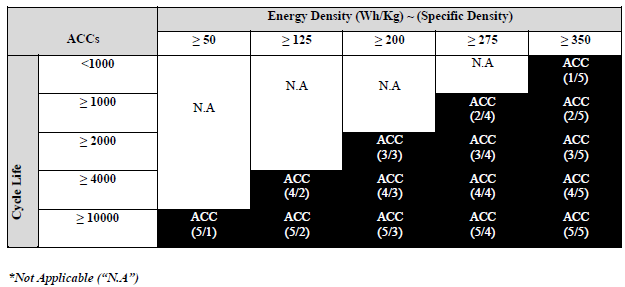

The PLI scheme will be technologically agnostic and covers ACCs and integrated advanced batteries (Single Units) that suffice the minimum performance specifications as provided hereunder (Shaded):

2. Eligibility Criteria

The beneficiary has to ensure achieving

- Net Worth

- In case the Bidder is not an AIF (Alternate Investment Fund) or Foreign Investment Fund: The Bidder shall have a minimum Net Worth of rupees 225 crore per GWh.

OR

- In case the Bidder is an AIF or Foreign Investment Fund: The Bidder shall have a minimum ACI at the close of the preceding financial year of rupees 225 crore per GWh.

Notwithstanding the foregoing, a Bidder may Bid for any capacity if such Bidder has a Net Worth of at least rupees 1,500 crores, under and in accordance with the terms of this RFP.

- Mandatory investment (₹ 225 crore /GWh) within 2 Years (at the Mother Unit Level)

- Domestic value addition (DVA) –

- At-least 25% and raise it to 60% domestic value addition within 5 Years, either at Mother Unit, in-case of an Integrated Unit, or at the Project Level, in-case of “Hub & Spoke” structure (the “Project”), as will be specified in the RFP.

- The ultimate onus to validate the value addition by ancillary units or domestic manufacturers would remain on the beneficiary firm.

- The required value addition if achieved in one single integrated unit will also be acceptable.

- Value addition (Similar procedure has been prescribed by the Central Government in the Notification No. 01/2010 – Central Excise, dated 06 February 2010) shall be construed as the percentage of manufacturing activity (manufacture ACC) being undertaken in India, by the beneficiary firm either on its own or through ancillary units or via domestic manufacturers.

- The ultimate onus to validate the value addition by ancillary units or domestic manufacturers would remain on the beneficiary firm. The required value addition if achieved in one single integrated unit will also be acceptable.

- Where the eligible unit is also engaged in manufacture of battery packs and a value addition till the cell stage could not be determined with the abovementioned approach, the percentage of value added calculated (as above) should be reduced as enumerated in the RFP/bid documents.

- There should be change in HSN at 6-digit level

- The final process of manufacture is performed in India at greenfield manufacturing facilities that produce ACC.

- The beneficiary firm shall not be eligible for availing any incentives on undertaking mere trading of finished ACCs from the Mother Unit or on not adhering to the aforementioned criteria subject to other conditions prescribed under the Programme.

- A Selected Bidder shall form an appropriate Special Purpose Vehicle, incorporated under the Indian Companies Act, 2013 (‘SPV’), to implement the Project. In case the Bidder is a Consortium, it shall, in addition to forming an SPV, comply with the additional requirements as mentioned under RFP.

3. Incentive rate and computation

- The actual subsidy disbursement to the beneficiary firm shall be capped at 20% of the ACC Sale Price (Net of GST)

- The amount of subsidy to be disbursed would be calculated as following:

Applicable subsidy amount per kilowatt hour X (multiplied) Percentage of value addition achieved during the period X (multiplied) Actual sale of Advanced Chemistry Cells (in KWh), as shall be specified in the RFP

- Incentive disbursement shall commence once the committed domestic value addition and actual sale of the ACCs begins. Thus, the cash-subsidy disbursement to the beneficiary firm would begin once the beneficiary firm has set-up ACC assembly facility and the value addition by the Mother Unit exceeds the aforesaid minimum threshold of 25%.

- The total annual cash subsidy to be disbursed by the Government will be capped at 20GWh per beneficiary firm.

- The breakup of fund allocation year wise, for the scheme’s duration is tabulated below (All amounts are in Rs. Crore) –

| Budgetary Provision | FY | 22-23 & 23-24 | 24-25 | 25-26 | 26-27 | 27-28 | 28-29 | Total |

| Subsidy (INR Cr.) | Setting up of manufacturing facilities | 2700 | 3800 | 4500 | 4300 | 2800 | 18100 |

4. Timeline

The timeline as prescribed in RFP document would be as follows:

| S.No. | Event Description | Date |

| 1 | Release of RFP | 22 October 2021 |

| 2 | Pre-Bid Conference | 12 November 2021 |

| 3 | Last date for receiving queries from Bidders | 21 November 2021 |

| 4 | Government response to queries | 17 December 2021 |

| 5 | Bid Due Date | 31 December 2021 |

| 6 | Opening of Technical Bid | 3 January 2022 |

| 7 | Opening of Financial Bid | 21 January 2022 |

| 8 | Letter of Award (LOA) | 4 February 2022 |

| 9 | Validity of Bid | 29 June 2022 |

5. RFP Related

- Prior to submission of the Bid, the Bidder shall pay to the Government a sum of INR 4,50,000 as the cost of the RFP process.

- A Bidder is required to deposit, along with its Bid, a bid security of rupees ten crore, refundable no later than 90 days from the Bid Due Date, except in the case of the Selected Bidder whose Bid Security shall be retained till it has provided a Performance Security under the Programme Agreement.

- The allocation to beneficiary firms shall be carried out through a transparent Quality and Cost Based Selection (“QCBS”) process which shall comprise of “two- envelop” system comprising:

- Technical bid and,

- Financial bid.

- Respective weights shall be allocated for technical criteria including total capacity and value addition targets, and amount of base cash-subsidy sought (per KWh ACC sold) under the financial criteria shall be subject to a ceiling of INR 2000 per KWh. Any Bid that has quoted Subsidy over INR 2000 shall be rejected..

- The SPV will be required to enter into an agreement with the Government for availing the Subsidy and specifying the details of implementation of the Project (Programme Agreement).

- The SPV shall also enter into a Tripartite Agreement with the Government and the State Government for availing additional incentives.

- No Bidder shall submit more than one Bid for the Project. A Bidder applying individually or as a Member of a Consortium shall not be entitled to submit another application either individually or as a Member of any Consortium, as the case may be. It is further clarified that any of the Parent Company/ Associate /Ultimate Parent Company of the Bidder or Member of a Consortium shall not separately participate directly or indirectly in the Bidding Process. Further, if any Bidder is having a Conflict of Interest with other Bidders participating in the Bidding Process, the Bids of all such Bidders shall be rejected.

- In-case of any breach of the commitments as submitted in the RFP, suitable penalty provisions will be specified in the RFP to ensure sincerity in the commitment of manufacturers.

6. Other aspects

- The manufacturing facility as proposed by the beneficiary firm under the RFP would have to be commissioned within a period of 2 years and the final process of manufacture is to be performed in India. The subsidy will be disbursed thereafter over a period of 5 years.

- The incentive claimed under this scheme will in no way debar/restrict for any incentive to be claimed under FAME-II or PLI scheme for Automobile and Auto components where ACC may be used as a part of the end product.

- Only the higher performance parameters would be the pre requisite for being eligible.

- Single-Window mechanism for the potential investors,

- State-level grand- challenge will be initiated, including provision for encumbrance-free land, trunk infrastructure facilities, power at rationale rate to the potential investors for attracting the Projects in their states.

Investments in manufacturing and overall value addition for ACCs are still negligible in India. Hence almost entire domestic demand of ACCs is still being met through imports. Through this Scheme, the Government of India intends to optimally incentivize potential investors, both domestic and overseas, to set- up Giga-scale ACC manufacturing facilities with emphasis on maximum value addition and quality output and achieving pre committed capacity level within a pre-defined time-period. Being the scheme is limited in terms of number of application involving bidding process, involvement of State Government for competitive bidding and additional incentives, time line and eligibility conditions, its utmost important to have adequate project management and support to deliberate and accordingly prepare the application and apply to obtain the approval.

About the Author:

Vineet has over 16 years of consulting experience in leadership role in Indirect tax including GST (around 13 years in Big 4) and working with leading players in diverse industry sectors including electric vehicle sector. He has conducted sessions on various tax and regulatory topics (including GST) at Client’s place, Business Parks, and other forums (ASCI, FTAPCCI, JICA, KOTRA, EPC, ICAI, ICFAI, JITO, RGA and others).

https://www.linkedin.com/in/d-vineet-suman-a5a28729

You can reach out on 91-99529 26239 or email [email protected].

Follow us: https://www.linkedin.com/company/darda-advisors-llp